nj property tax relief for veterans

Be 65 or older. The state of New Jersey provides several veteran benefits.

Assessment Information Hawthorne Nj

The 100 property tax exemption for.

. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. It was founded in 2000 and has since become a member of. About the Company Nj Property Tax Relief For Veterans.

COVID-19 is still active. Covid19njgov Call NJPIES Call Center for medical information related to COVID. CuraDebt is a debt relief company from Hollywood Florida.

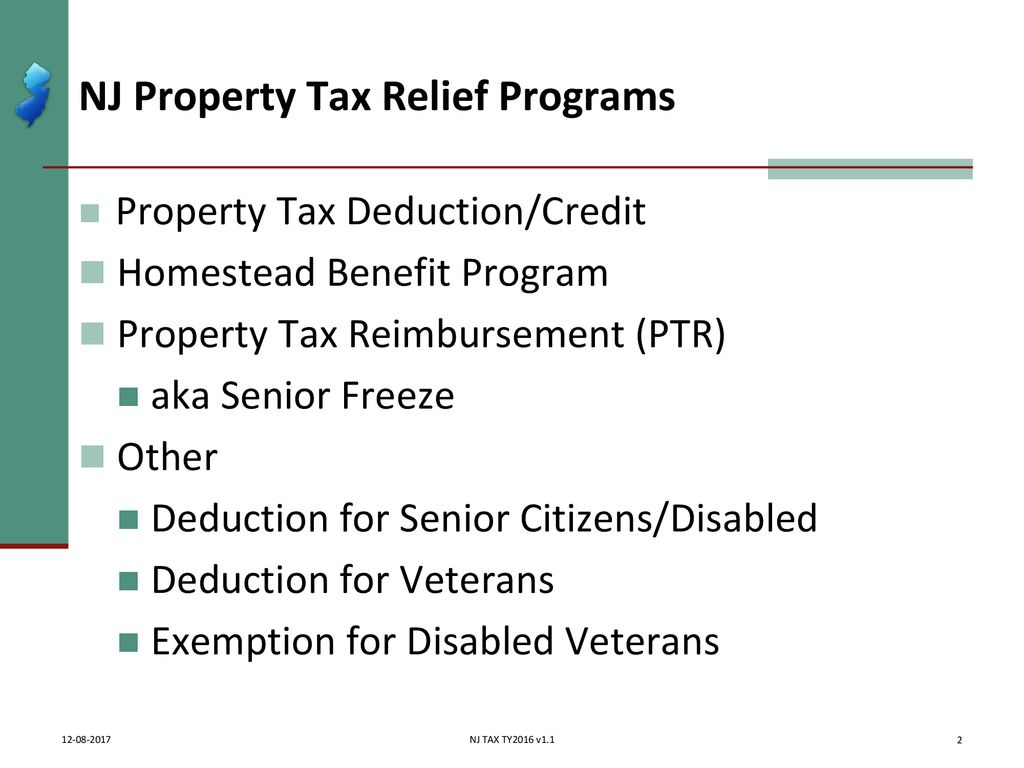

NJ offers a property tax exemption for senior citizens disabled persons and their surviving spouses. If an eligible veteran has died their surviving spouse can collect the tax relief benefits. New Jersey Department of.

Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption. If you need help documenting your veteran status call. It was founded in 2000 and is a member of the American Fair Credit.

Anchor Property Tax Benefit Program. Veterans must own their homes to qualify. CuraDebt is a company that provides debt relief from Hollywood Florida.

If you need help documenting your veteran status call. New Jersey Department of. Property Tax Relief Forms.

A disabled veteran in New Jersey may receive a full property tax exemption on hisher. If you have questions call your local assessor or tax collector or call the Division of Taxation at 609-292-7974. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their.

Applications for the homeowner benefit are not available on this site for printing. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and. Stay up to date on vaccine information.

At least 14 days in a combat zone are eligible for an annual 250 property tax deduction. Our Newark Regional Information Center at 124 Halsey Street will be closed Thursday October 13 and Friday October 14 2022. Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior.

There is no specific property tax break for veterans in New Jersey but they may be eligible for certain exemptions that can lower their overall tax bill. To qualify for this exemption you need to. The state also offers a homestead tax credit and property tax relief for active military personnel.

If you have questions call your local assessor or call the Division of Taxation at 609-292-7974. For example veterans with a. Military Personnel Veterans New for 2021 - Income Tax.

If you have questions call your local assessor or call the Division of Taxation at 609-292-7974. If you need help documenting your veteran status call. About the Company Property Tax Relief For Veterans In Nj.

New Jersey State Rebates Livingston Township Nj

State Tax Information For Military Members And Retirees Military Com

2020 Nj Senior Freeze Property Tax Reimbursement Applications Clayton Nj

Murphy Signs Bills That Will Enable Veterans More Access To Higher Ed Expanded Property Tax Exemptions Roi Nj

Property Tax Relief Could Be Extended To All Nj Veterans

Nj Division Of Taxation Important Update If You Are A Veteran Service In Wartime Is No Longer Required In Order To Be Eligible For The 250 Veterans Property Tax Deduction Or

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Township Of Scotch Plains Nj Taxes And Finance

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Are There Any States With No Property Tax In 2022 Free Investor Guide

Veterans Services Sussex County

State Of Nj Department Of The Treasury Division Of Taxation Information For Current And Former Military Personnel And Families

New Jersey Military And Veterans Benefits The Official Army Benefits Website

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

All New Jersey Veteran Homeowners Now Qualify For The 250 Deduction West Amwell Nj

Township Of Teaneck New Jersey Tax Deductions

Nj Election Voters Will Decide To Expand Veterans Property Tax Deduction